How Do I Choose My Investments?

Some people do not participate in their retirement plan because they don't have the knowledge they need to feel comfortable making investment decisions. By taking a moment to review the investment education provided below, you will gain an understanding of investment fundamentals such as asset categories and investment risks, asset classes and other investment types.

- Investment Fundamentals

- Asset Category Overview

- Target Date

Funds - Guaranteed

Retirement Income - Actively vs. Passively

Managed Funds

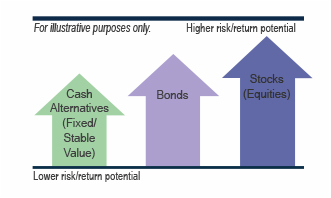

Investment Building Blocks

Cash Alternatives—Investments in which the underlying principal you invest is generally stable or preserved.1

Bonds—Investments in which you are lending money to the bond issuer to be repaid on a certain date with interest.

Stocks, or Equities—Investments in which you become part-owner of the company and share in its profits and losses.2

Managing Risks

Asset Allocation—Balance risk and return by putting a percentage of your money into the different asset classes (cash alternatives, bonds and stocks).3

Diversification—You can take asset allocation a step further and diversify or divide up your money within each asset class to also help balance risk.3

Beware of Inflation—Just as you should be aware of investing too aggressively, you should also be aware of being too cautious. When you’re ready to retire, you’ll most likely be living in a much more expensive world than we live in today due to inflation.

Invest for the Long Term—The market will have ups and downs, but if you invest wisely and invest for the long term you’ll have a better chance of reaching your long-term investment goals.

Investment Risks

Market Risk—An investment may drop in value due to a decline in the financial markets.

Business Risk—An investment may drop in value due to a decline in a particular industry or company.

Inflation Risk—An investment may not outpace the rate of inflation.

Interest Rate Risk—An investment may fall in value if interest rates rise.

International Risk—An international investment may drop in value due to political, economic or currency instability.

Risk of Not Investing—The risk that you will not have enough retirement income for a secure future.

Develop Your Investment Strategy

Your Savings Target—Consider the amount of money you need to save and invest for a comfortable retirement.

Your Time Horizon—Consider the amount of time you have to invest in your Plan before you retire.

Your Risk Tolerance—Consider your comfort level with the ups and downs in the value of your investments.

1 Cash alternatives are not federally guaranteed and may lose value. Cash-alternative portfolios have interest rate, inflation and credit risks that are associated with the underlying assets owned by the portfolio.

2 A bond fund's yield, share price and total return change daily and are based on changes in interest rates, market conditions, economic and political news and the quality and maturity of its investments. In general, bond prices fall when interest rates rise and vice versa.

3 Asset allocation and/or diversification of an investment portfolio does not ensure a profit and does not protect against loss in declining markets.

International Funds primarily invest in equity securities of companies based outside the United States, including companies based in Asia, Europe and emerging markets.

International investments may be most appropriate for someone looking for greater potential returns and who is and willing to accept a higher degree of risk. International investments may provide diversification for a domestic portfolio. Foreign investments involve special risks, including currency fluctuations and political developments. International securities may also be subject to somewhat higher taxation as well as less liquidity compared to domestic investments.

Small-Cap Funds primarily invest in equity securities of public companies located in the United States that have market capitalizations of less than $2 billion. Market capitalization is a measure of a company's size and is calculated by multiplying the number of outstanding shares by the current market price.

Small-cap investments may be most appropriate for someone with a longer investment horizon, and who is seeking long-term capital growth and is willing to accept larger market fluctuations. Equity securities of small-sized companies may be more volatile than securities of larger, more established companies.

Mid-Cap Funds primarily invest in equity securities of public companies located in the United States that have market capitalizations of less than $10 billion but greater than $2 billion. Market capitalization is a measure of a company's size and is calculated by multiplying the number of outstanding shares by the current market price.

Mid-cap investments may be most appropriate for someone seeking higher potential returns over time and willing to weather market downturns. Mid-cap stocks may be more volatile than large-cap stocks but with potentially higher return.

Large-Cap Funds primarily invest in equity securities of public companies located in the United States that have market capitalizations greater than $10 billion. Market capitalization is a measure of a company's size and is calculated by multiplying the number of outstanding shares by the current market price.

Large-cap investments may be most appropriate for someone willing to accept market fluctuations in return for long-term capital growth. Stock investments tend to be more volatile than bond or money market investments.

Balanced Funds use both stocks and bonds to moderate market fluctuations in the equity markets.

Balanced investments may be most appropriate for someone seeking a balance between income from bond investments and capital growth from equity investments in one option. The investor is willing to accept higher risk for greater potential returns, rather than investing in bonds alone.

Bond Funds primarily invest in debt securities of government agencies and private companies. They provide income based on the interest or yield of the underlying bonds. Changes in interest rates and the stability of the issuer can affect the value of the underlying bonds. Unlike money market and fixed funds, bond funds can result in a loss of principal.

Bond investments may be most appropriate for someone seeking higher potential income than with a money market fund or stable value investment. The investor may desire to balance some of his/her more aggressive investment, with one providing potentially steady income.

Fixed Funds primarily invest in short-term to medium-term, high-quality debt securities. Each quarter a new rate is determined, effective for the remainder of the crediting period. These funds are also referred to as stable value funds because they strive to provide safety of principal and stable income.

Stable value investments may be most appropriate for someone wanting to safeguard principal value or to balance out a more aggressive portfolio. This investor may be nearing retirement and requires more stability and asset liquidity.

Money Market Funds invest in short-term debt securities that earn interest and strive to maintain principal.

Money market investments may be most appropriate for someone wanting to safeguard principal value or to balance out a more aggressive portfolio. This investor may be nearing retirement, requiring more stability and asset liquidity.

You could lose money by investing in a money market fund. Although the fund seeks to preserve the value of your investment at $1 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Profile Funds, also known as asset allocation funds, invest in a mix of underlying funds across a variety of asset classes providing immediate diversification.1 The funds are constructed by investing in a mix of international and domestic equity funds, bond funds, as well as fixed income investments and cash equivalents.

The allocation mix in these investments is based on an investor's risk level, ranging from aggressive to conservative. An aggressive profile fund, as an example, would have more equity investments and less bond and fixed income investments than a conservative profile fund's mix would have. Investors choosing these options want to invest in a mixture of diverse investments suiting their level but do not have the time, desire, or knowledge to select and manage their own portfolios.

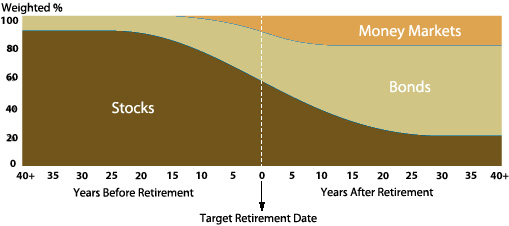

Target Date Funds are designed for people who may not have the time or willingness to build and manage their own investment portfolios. You simply choose the fund with the date that is closest to your planned retirement year (your "target date").

Target Date Funds are designed to provide a diversified investment approach with a changing asset allocation mix that helps you manage risk automatically as you get closer to retirement. Over time, the fund shifts into traditionally more conservative holdings by gradually reducing the allocation of equity funds and increasing the allocation of fixed income and short-term funds as you move toward your anticipated retirement date.

The date in a Target Date Fund represents an approximate date when an investor would expect to start withdrawing his or her money or when an investor expects to retire. Consult the fund's prospectus or disclosure documents for more information regarding the Target Date Fund's date. Keep in mind that the principal value of a Target Date Fund is not guaranteed at any time, including the target date.

Rather than trying to mix and manage a collection of different funds, you only need to select one Target Date Fund to ensure a diversified investment mix.1

FOR ILLUSTRATIVE PURPOSES ONLY. Intended to show how a Target Date Fund's asset allocation mix will change over time as the target date named in the fund nears. The gradual change in asset allocation mix is also known as a fund's "glide path". This graphic is not intended to represent the actual glide path of any specific fund in your plan. For more information regarding investments in your plan, please consult the fund's prospectus or disclosure documents.

1 Diversification of an investment portfolio does not ensure a profit and does not protect against loss in declining markets.

A guaranteed lifetime withdrawal benefit (GLWB) is an investment option that can be used to provide guaranteed retirement income for life subject to the claims paying ability of the insurer. A GLWB can be provided in the form of a mutual fund coupled with an investment contract, such as a contingent deferred annuity or variable annuity. A GLWB owner will make his or her investment directly into the associated investment contract, while incurring expenses associated with both the GLWB and the investment contract. The investment contract's value can rise and fall due to contributions, withdrawals, and the performance of the market. However, the GLWB provides a guarantee that the owner will be able to receive a fixed percentage of the owner's investment.

Passively Managed Funds

Passively managed funds, often called index funds, are designed to produce returns similar to those you would earn if you owned the securities in a particular market index. The funds are called passive because the way your money is invested is determined by the securities included in a particular market index and not at the discretion of a professional portfolio manager. Each fund has a stated investment objective included in its prospectus.

What is a market index?

An index tracks a particular group of securities that is representative of a market as a way of measuring that market’s performance. For example, the Standard & Poor’s (S&P) 500® Index is an index considered indicative of the large-cap domestic equity market. It is the benchmark index to which many large-cap stock managers compare their performance. Because it is a measurement tool, you cannot invest directly in a benchmark index.1

You can elect to invest in a fund that is managed to mirror the S&P 500 Index by investing in the stocks comprising the S&P 500 Index.

The Right Type of Investor

What type of investor should consider investing in a passively managed fund? This investment approach offers investors the opportunity to select an allocation of funds that follows different market indices. An investor may be comfortable with potentially lower returns than actively managed funds in exchange for generally lower fees due to less fund management. Each fund and the market index it follows has unique inherent risk.

Understanding Actively Managed Funds

Actively managed investment choices are managed by a team of professionals that use research, financial analysis and personal expertise to determine which securities to buy and sell. Each fund has a stated investment style and strategy included in its prospectus. Unlike passively managed funds, actively managed funds seek to outperform the market index. The potential to outperform the market is one advantage that actively managed funds have over index funds.

There is no guarantee that a portfolio manager of an actively managed fund will accomplish the goal of producing higher returns than the fund’s established benchmark. Depending on the underlying investments, returns may even be less than the benchmark index.

Actively managed funds also tend to have higher expense ratios than index funds due to the expenses of the investment manager, staff and other resources used in deciding which securities to buy and sell. The investment style and strategy of actively managed funds can change over time, so regular review of a fund’s prospectus by plan participants is encouraged.

Actively Managed Investment Styles

Investment style refers to the way a portfolio manager chooses and manages a portfolio of securities. While not a comprehensive list, the following includes the most common investment styles used for picking stocks.

Growth–Managers utilizing this style invest in stocks that have potential to outperform the market over time. Growth stocks usually pay little or no dividends and typically have strong earnings growth potential; however, there is no assurance that the earnings growth potential will be realized over time. As a result, these stocks tend to be more volatile and, therefore, more risky.

Value–Managers utilizing this style invest in stocks that are considered undervalued relative to criteria established by that portfolio manager, but which have potential to increase in value over time. Stocks in value portfolios often have higher dividend yields, which bring additional consistency to returns.

Blend–Managers utilizing this style invest in a combination of both growth and value investment styles.

These investment styles can be segmented further by market capitalization. A fund can also include specific investment strategies, including, but not limited to market sector, asset classification, asset allocation and geography.

The Right Type of Investor

What type of investor should consider investing in actively managed funds? This investment approach allows investors the opportunity to select an allocation of funds that strives to outperform various benchmark indices with potentially greater return. There is a risk that a fund may not reach its stated objectives and performance goals. An investor must understand the risks and generally higher expenses associated with actively managed funds and accept them as part of his or her overall retirement strategy in pursuit of greater return potential.

1 S&P 500® Index is a registered trademark of Standard & Poor’s Financial Services LLC. A benchmark index is not actively managed, does not have a defined investment objective, and does not incur fees or expenses. Therefore, performance of a fund will generally be less than its benchmark index. You cannot invest directly in a benchmark index.